Microfin360 is a cutting-edge, web-based software designed specifically for microfinance institutions. This powerful platform streamlines and automates workflows, making it easier to manage microfinance operations. With real-time data synchronization, robust monitoring capabilities, and centralized financial reporting, Microfin 360 transforms how microfinance businesses operate.

By adopting Microfin360, organizations can perform all aspects of their operations with greater efficiency and security. The software ensures secure transactional data entry, reducing the need for manual intervention and minimizing errors. Moreover, Microfin 360 complies with regulatory authorities and meets the needs of patrons, partners, donors, and funding organizations.

What is Microfin 360?

A sophisticated software program platform designed specifically for the microfinance enterprise is referred to as Microfin 360. It affords an extensive range of services that cope with the unique wishes of microfinance institutions (MFIs). From customer management to financial reporting, the platform streamlines and automates numerous approaches, enabling institutions to run extra profitably and extend their services.

In other words, Microfin 360 is a comprehensive software platform tailored for the microfinance industry, offering a wide array of services that address the specific needs of microfinance institutions (MFIs). It enhances efficiency by streamlining and automating various processes, including customer management and financial reporting. This enables MFIs to operate more profitably and expand their services, ultimately supporting their mission to provide financial access to underserved populations.

Key Features of Microfin 360

1. Complete microfinance 360 management.

A robust microfinance manipulation gadget is in which Microfin 360 shines. The platform is an all-in-one answer for coping with microfinance gives, supporting a wide range of monetary merchandise including savings bills, loans, and insurance.

2. The Integration of TMSS Microfin360

Microfin 360 connection with TMSS (The Microfinance Software Solution) is one of its most tremendous aspects. Through this interface, customers might also take advantage of both Microfin 360’s and TMSS’s state-of-the-art competencies, supplying a clean revel in coping with microfinance operations. Operational overall performance and truth consistency are assured by using TMSS Microfin360.

3. An Interface That’s Easy to Use

Microfin 360 boasts a client-pleasant interface that simplifies complicated techniques. Its intuitive design allows clients to navigate through the platform effectively, decreasing the knowledge of the curve and improving productivity.

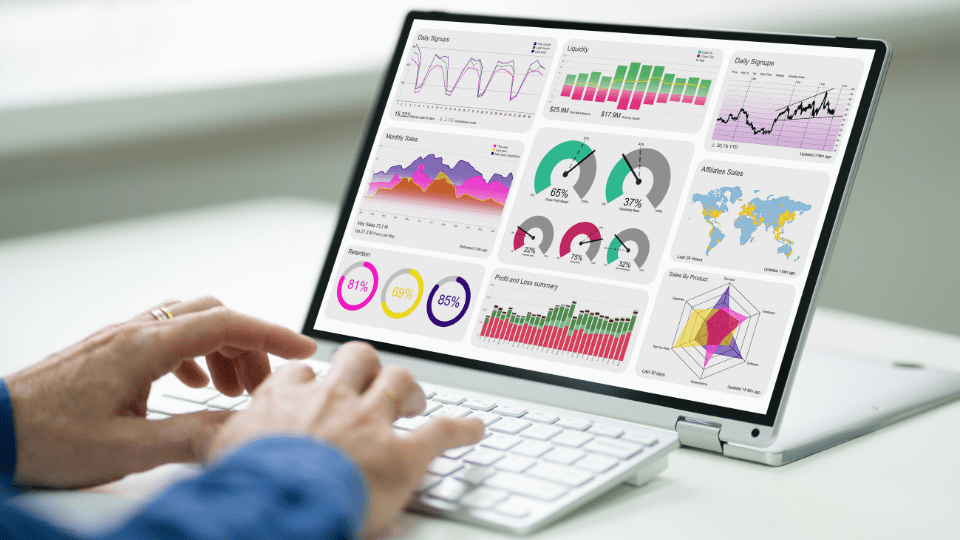

4. Advanced Reporting and Analytics

Institutions are capable of offering custom-designed economic reviews and insights because to the platform’s excellent reporting and analytics gear. This characteristic is important for monitoring the effectiveness of Microfinance 360 applications and making properly knowledgeable choices.

5. Safety and Observance

Microfin 360 offers compliance and safety first precedence. The platform complies with company requirements and guidelines, ensuring the security of your records and the continued compliance of your sports with jail regulations.

Benefits of Using Microfin 360 Enhanced Efficiency

By automating ordinary obligations and mixing more than one functionality, Microfin 360 optimizes operational overall performance. Institutions might awareness aware of their middle sports activities and much less of guide strategies.

Scalable Solutions

Microfin 360 is made to increase together with your employer. It is a destiny-evidence solution for growing microfinance 360 operations due to its scalable capabilities that may take care of increasing amounts of statistics and transactions.

24/7 Customer Support

With its full manipulation system, Microfin 360 allows groups to supply better providers to their clientele. Improved client satisfaction is the result of quicker processing instances and accurate statistics management.

Why Choose Microfin360?

Selecting the Microfin 360 tmss technique entails deciding on a tried-and-genuine, dependable solution that is customized for the microfinance region. Its consumer-friendly layout and interaction with TMSS distinguish it from other software program solutions. Microfin 360 tmss offers unparalleled pricing and performance for groups looking to beautify their microfinance control abilities.

Conclusion

One of the great options for microfinance 360 manipulation is Microfin 360. Its advanced functions, intuitive design, and interaction with TMSS make it an essential device for microfinance businesses. With Microfin 360, take control of the destiny of microfinance control and attain a brand new level of operational excellence.